Fascination About Dui And Auto Insurance In The US

These rates are a sample set meant for comparison just. DUI. Your own rates will differ. Car insurance coverage can protect you financially while you lag the wheel, and essentially every state needs you to have it.

Some Ideas on How Long Does A Dui Affect Auto Insurance Rates

Just how much you'll pay for your insurance depends upon a variety of aspects, including your driving record. Being founded guilty of driving under the influence( DUI )or driving while intoxicated (DWI) could trigger your rates to increase. There are likewise a couple of steps you can require to potentially save money. DUI, DWI, and Your Driving Record Being convicted of a DUI or DWI generally indicates that you were.

discovered to be driving under the impact of alcohol and/or other substances in offense of your state laws. Other compounds can consist of controlled substances, along with particular prescription drugs and non-prescription medications. Some states might include household chemicals used as inhalants, such as paint thinner or glue, in that category too. States differ in terms of the charges they enforce when a driver is convicted of a DUI or DWI offense. Generally, the more DUI or DWI convictions you have, the more severe the charges become. You may likewise be needed to take an authorized safe driving course. Crucial In some states, refusing to take a breath analysis test after being pulled over on suspicion of DUI consequences will result in an automatic license suspension. How a DUI or DWI Impacts.

The Basic Principles Of Car Insurance For Drivers With Duis

Having your driver's license suspended or withdrawed because of a DUI can trigger your insurance provider to drop you or not renew your policy when the time comes. And you may have a hard time getting brand-new protection. Depending upon your state, a conviction could remain on your driving record for up to 10 years, though a handful of states keep them on your record for life. Typically, you can expect to pay more for car insurance when you have a DUI on your record. Just how much more may depend upon several elements, including: How your insurer examines risk for motorists with a DUI record Whether it's your first DUI offense or a subsequent offense The number of DUIs/DWIs you have on your record altogether Your age Just how much time has passed given that the DUI offense was included to your driving record Your total driving history( how many accidents you have actually had, the number of speeding tickets, and so on )If you need to get new insurance coverage following a DUI conviction, it is very important to ensure you're meeting the standards for coverage in your state.

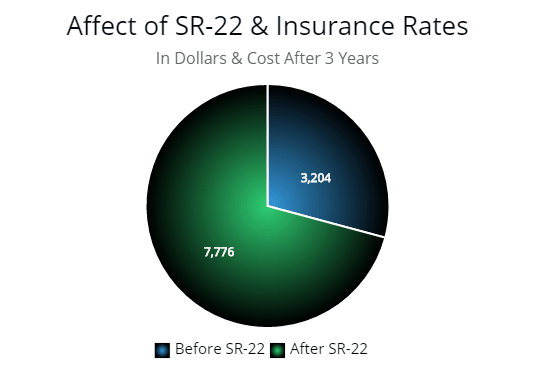

If you financed your car, your lending institution might also expect you to have collision and/or detailed coverage to pay for any needed repairs. Space insurance coverage is another coverage you may wish to buy if you have a funded vehicle and still owe money on it. SR-22 Protection May Be Required in addition to liability coverage, you may require to provide an SR-22 certificate when getting cars and truck insurance with a DUI conviction. This certificate basically acts as proof of minimum liability insurance protection and reveals that you can bear financial obligation for any accidents you may be included in.

Not known Incorrect Statements About How Long Does Dui Affect Insurance Rates

SR-22 insurance coverage isn't needed in every state or in every scenario. However typically, you might require to have it if: You've been founded guilty of a DUI/DWI You have many moving offenses on your driving record Your motorist's license has actually been suspended or withdrawed If your state requires you to have SR-22 protection to get a suspended license reinstated after a DUI, you may have the ability to acquire it through your car insurance provider. Essential If you permit your SR-22 certificate to lapse or you cancel it while it's still required, your motorist's license might be suspended. How to Conserve on Insurance Coverage After a DUI. Initially, store around and compare rates from different cars and truck insurance provider. It's possible that your present carrier may be the best choice, however, another insurance company might offer better rates.

How Does A Dui Affect Car Insurance Rates?

Be upfront about your driving record and whether you need SR-22 coverage as well as liability insurance coverage. Next, inquire about any discount rates you're qualified for that could reduce your car insurance premiums.

How Much Is Car Insurance With A Dwi In Houston?

For instance, you might be able to get a great motorist discount rate if you have no additional traffic violations given that the DUI. Or you may have the ability to get a discount for bundling your cars and truck insurance with your house owners or occupant's policy at the exact same insurance coverage business. A higher deductible will equate into lower premiums, however it also implies you'll have to pay more expense if you have an accident. So ensure you have the funds readily available, just in case.